Is Commercial Loan Debt Headed about to hit a Brick Wall?

The commercial loan debt market is starting to look like a ticking time bomb—one that might just blow up in 2024-25. And no, I’m not talking about a cute little firecracker. I’m talking about a $929 billion explosion waiting to happen. So, let’s dive into what’s going on, why you should care, and where the opportunities (and pitfalls) might be hiding.

The Fed’s Rate-Hike Bender

The Fed’s been cranking up interest rates like there’s no tomorrow. Their goal? Curb inflation. The result? Commercial loan holders are getting squeezed. Higher rates mean higher borrowing costs, and for anyone trying to refinance in this environment, well, good luck. The days of cheap money are over. Now it’s pay-to-play, and some folks are running out of chips.

Office Space is the New Dinosaur

Remember when prime office space was like gold? Yeah, not so much anymore. Thanks to the whole work-from-home revolution, office buildings are more like overpriced paperweights. Companies are downsizing their physical footprints, and as demand dries up, so do valuations. Those sleek, shiny office towers you see downtown? They might soon become empty glass monuments to a pre-COVID world.

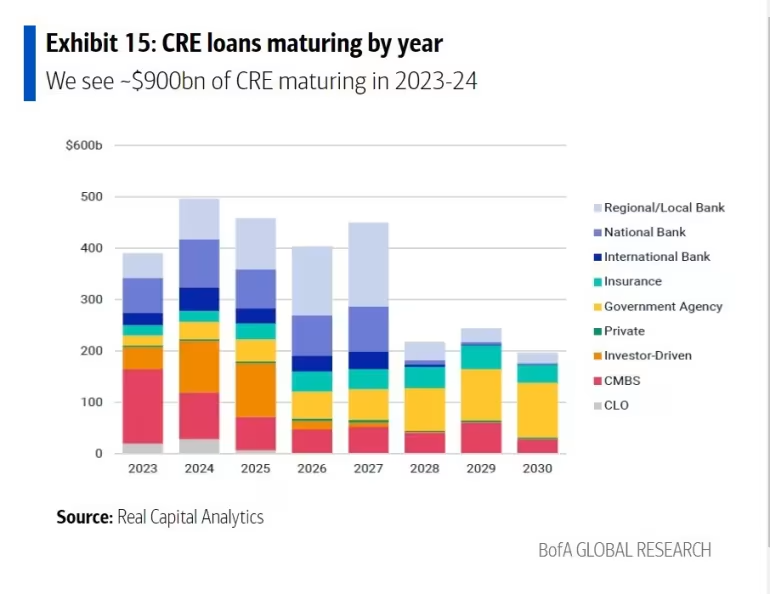

$929 Billion in the Crosshairs

Here’s the kicker: nearly $929 billion in commercial mortgages are coming due in 2024. That’s a lot of loans needing to be refinanced in a high-rate environment. And refinancing at these rates? Let’s just say it’s not going to be pretty. Some property owners are about to find themselves stuck holding the bag.

The Canary in the Coal Mine

We all know what happens when people can’t pay back their loans, right? Defaults. And we’re starting to see hints of that in the commercial real estate sector. Keep an eye on those default rates—they’re like the canary in the coal mine. If they spike, expect more trouble ahead.

Regional Banks in the Crossfire

Now, here’s something most people aren’t talking about: regional banks. These smaller institutions are sitting on a mountain of commercial real estate debt. If defaults start to climb, regional banks could be the first dominoes to fall. Think 2008 but with fewer subprime mortgages and more empty office buildings.

And it’s not just a theory—recent earnings reports from these banks are starting to show some stress in their commercial loan portfolios. If the trend continues, we might be looking at a ripple effect that spreads across the entire economy.

Is There Opportunity in All This Chaos?

You know what they say: when there’s blood in the streets, buy property (or do they?). Commercial real estate (CRE) is a hot mess right now. Office buildings are struggling, but other sectors like multifamily housing and logistics are looking a lot more stable. There’s a chance that some of these distressed assets could turn into hidden gems, but—big but here—you have to be smart about it.

This isn’t for the faint of heart. You’ll need to dig into financial models, forecast earnings, and most importantly, evaluate risk. But if you can handle the volatility, there could be real opportunities hiding under the rubble.

Seeing Through the Fog

If you want to go after these distressed commercial properties, you’ll need to sharpen your pencils and dust off your financial models. Start by forecasting cash flows—occupancy rates, rental income, all that good stuff. But remember, in a world where remote work is the new normal, don’t expect those office spaces to fill up overnight.

Also, take a good, hard look at the balance sheets of regional banks. The more exposure they have to commercial loans, the riskier they become. Some of these banks might end up as collateral damage in this whole mess.

Valuation: DCF and P/E Ratios to the Rescue?

When it comes to valuing these assets, Discounted Cash Flow (DCF) is your friend. Just remember to bump up the discount rate—there’s a lot more risk baked into these assets now. Comparing P/E multiples to historical averages can also help spot undervaluation in companies with solid fundamentals.

But don’t just dive in because the numbers look good on paper. Take a look at management quality too. If the team running the show is flailing, you might want to think twice.

The Data Doesn’t Lie: Using Alternative Insights

Here’s where things get cool. Want to know how a retail property is doing post-pandemic? Don’t just rely on traditional data. Look at web traffic to see if people are engaging with these brands online. Or even better, use satellite imagery to spy on parking lots and foot traffic. If the lot’s empty, the property probably isn’t doing so hot.

Finally, run some correlation analysis between interest rates and default rates. If you can identify patterns, you’ll get a better sense of when things might go from bad to worse.