The Great China Slowdown: How It’s Shaking Up the World

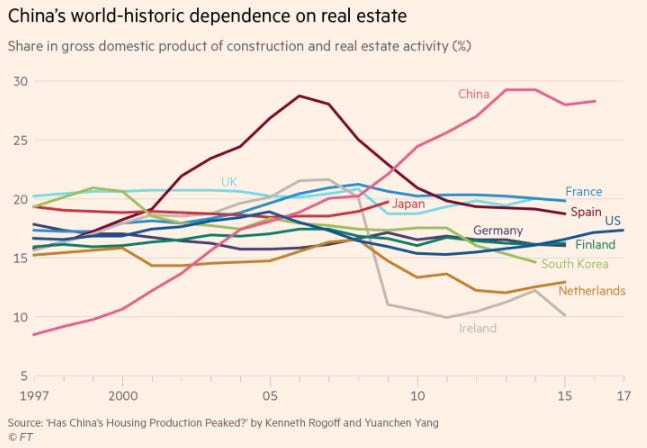

China’s economy is under intense pressure. What used to be a powerhouse is now struggling, thanks to a collapsing real estate sector and some tough demographic challenges. Here’s what’s happening and why it matters.

The Real Estate Pillar is Cracking

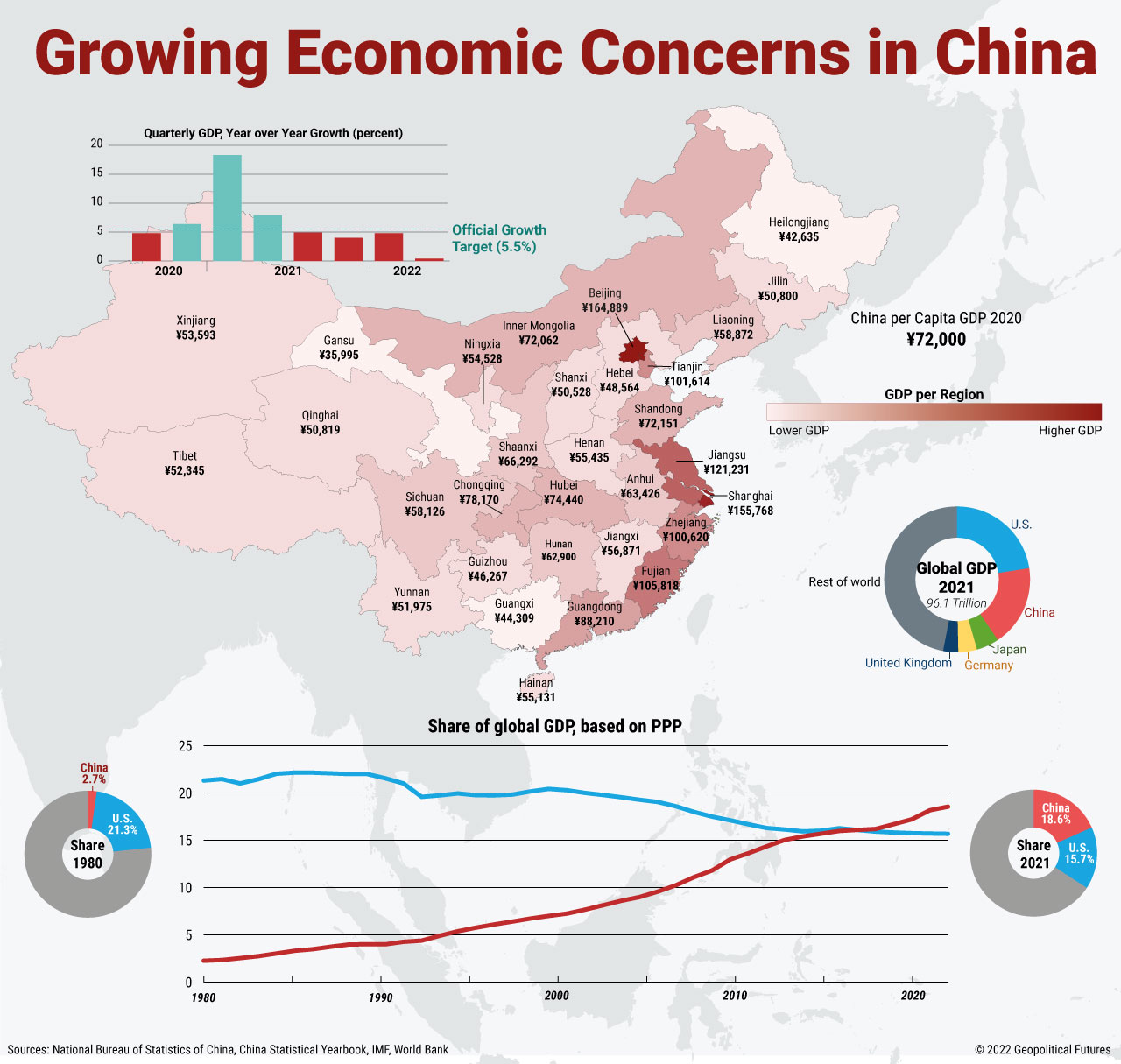

China’s real estate market, once a key driver of growth, is in a nosedive. Home prices dropped 4.5% year-on-year in June 2024, the biggest decline in nearly a decade. New-home sales in 30 major cities fell by 47% in March compared to last year, and major developers like Evergrande and Country Garden are drowning in debt. With real estate making up nearly a third of China’s GDP, this crash is a big deal for the entire economy.

Aging Population and Youth Unemployment

On top of the real estate woes, China’s demographic issues are adding to the pressure. The population is aging rapidly, and the pension system is strained—it might even run out of funds by 2035. Meanwhile, youth unemployment is on the rise, causing more economic stress.

The government is trying to counter these issues by expanding the social security fund and easing mortgage rates, but these solutions may only offer short-term relief.

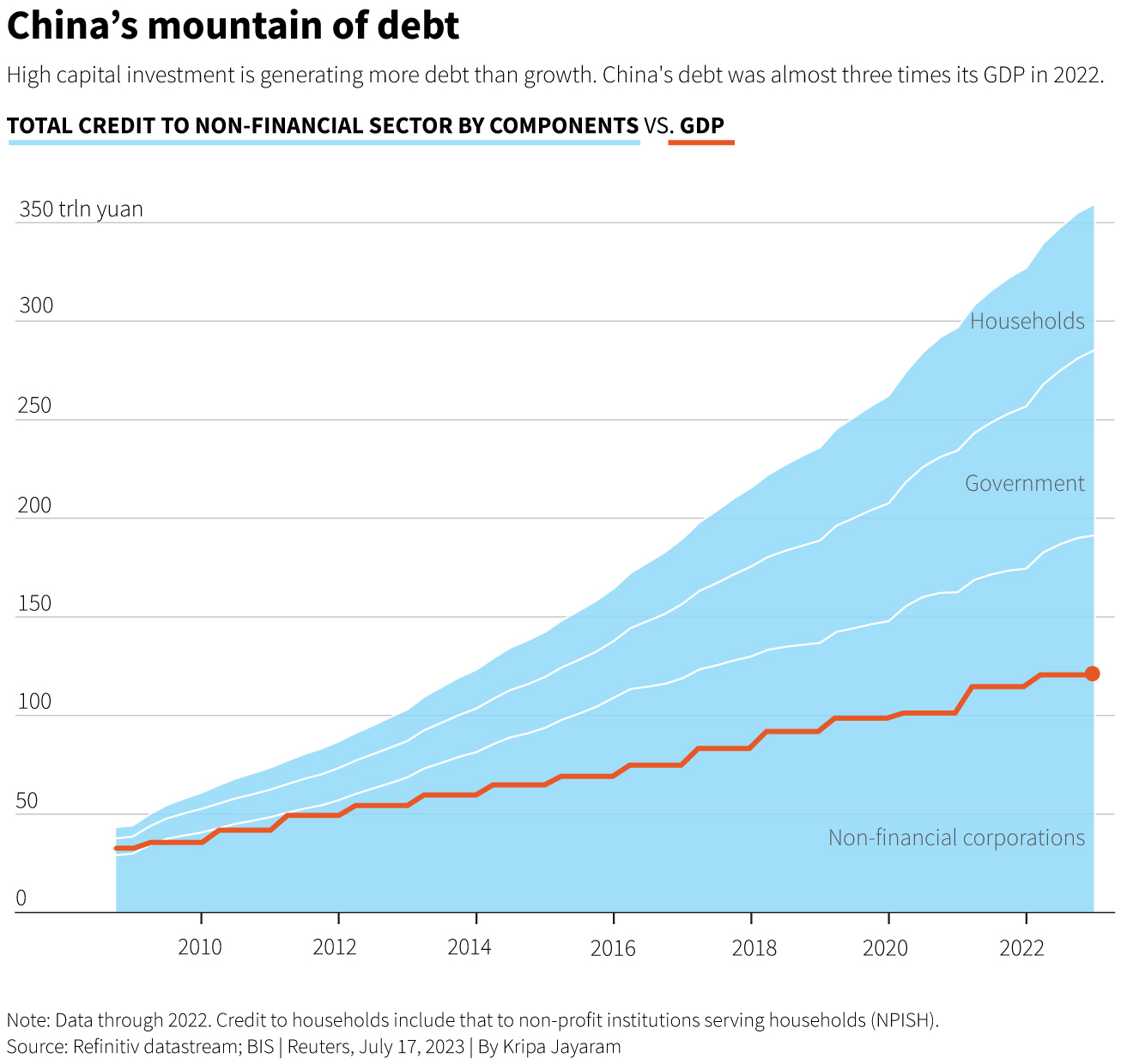

The Great Wall of Debt

China’s debt levels are a serious concern. By the end of 2022, China’s total non-financial debt had reached a staggering 297% of GDP, one of the highest levels in the world. And it’s still growing—total debt rose by 9.8% in 2023 and continued to climb in 2024. Local governments, in particular, are in deep, having relied heavily on debt to fund infrastructure and spur economic growth as consumer spending lagged.

The property sector’s collapse has only made things worse, as defaults by major developers like Evergrande have hit local governments hard. These governments depend on land sales for revenue, and with the real estate market in freefall, their debt burdens are becoming even more unsustainable.

The Chinese government has been trying to rein in debt since 2016, but it’s a tough balancing act. On one hand, there’s a need to stimulate the economy, especially post-COVID. On the other, high debt levels pose a serious risk to China’s financial stability and long-term growth prospects. This debt overhang also limits Beijing’s policy options, making it harder to boost the economy without digging the debt hole even deeper.

The Global Impact: When China Slows, the World Feels It

China’s problems aren’t staying within its borders—they’re affecting the global economy. As the world’s manufacturing hub, any slowdown in China can disrupt supply chains, leading to shortages and price hikes in everything from electronics to cars.

Weaker demand from China also means trouble for countries that export to China, especially in sectors like luxury goods. If the yuan depreciates, we could see a chain reaction in global trade balances and currencies.

Financial markets are already reacting. Increased volatility and capital outflows are a sign that investors are getting nervous. If China’s economy continues to struggle, expect global growth forecasts to take a hit.

The Chinese economy is doing fiiiiiiiiiiine *CRASH*#DoverCliffs pic.twitter.com/UwDXexs8VM

— JohannesBorgen (@jeuasommenulle) August 27, 2024

The China Watchlist

With China’s economy in trouble, here are some areas that could be effected, whether you’re looking for opportunities or trying to avoid risks:

Opportunities:

Global Supply Chains: Companies in India and Vietnam might benefit as manufacturers diversify away from China.

• ETFs: iShares MSCI India ETF (INDA), VanEck Vietnam ETF (VNM)

Defensive Sectors: Utilities, consumer staples, and healthcare stocks could be safer bets in a global slowdown.

• ETFs: Consumer Staples Select Sector SPDR Fund (XLP), Health Care Select Sector SPDR Fund (XLV)

Volatility and Safe Havens: With markets on edge, volatility indices, gold, and U.S. Treasuries might see more interest.

• Tickers: ProShares VIX Short-Term Futures ETF (VIXY), SPDR Gold Shares (GLD), iShares 20+ Year Treasury Bond ETF (TLT)

Cybersecurity and Defense: Rising geopolitical tensions could benefit defense stocks and cybersecurity firms.

• ETFs: ETFMG Prime Cyber Security ETF (HACK), iShares U.S. Aerospace & Defense ETF (ITA)

Semiconductors: Countries building their own chip industries could boost semiconductor equipment makers.

• ETFs: VanEck Semiconductor ETF (SMH), iShares Semiconductor ETF (SOXX)

Risks:

China-focused ETFs: ETFs with heavy exposure to Chinese markets might struggle as the economy slows.

• ETFs: iShares MSCI China ETF (MCHI), KraneShares CSI China Internet ETF (KWEB), iShares China Large-Cap ETF (FXI), Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR), Invesco China Technology ETF (CQQQ)

Luxury Brands: Companies relying heavily on Chinese consumers could face declining sales.

Chinese Real Estate and Banks: Developers and banks with big exposure to China’s property sector are at high risk.

• Tickers: Direxion Daily FTSE China Bear 3X Shares (YANG) - inverse ETF, ProShares UltraShort FTSE China 50 (FXP) - inverse ETF

Global Tech Tied to China: Tech companies with major operations in China might see disruptions and revenue hits.

• ETFs: iShares MSCI Global Metals & Mining Producers ETF (PICK), SPDR S&P Metals & Mining ETF (XME)

China’s Problems Are Everyone’s Problems

China’s economic issues are a reminder of how connected we all are. The real estate crash, soaring debt, demographic challenges, and global ripple effects make this a critical time for investors. Whether you’re looking to capitalize on the situation or just protect your portfolio, keeping an eye on China is more important than ever.