U.S. housing starts declined 6.8% in July to about 1.2 million units.

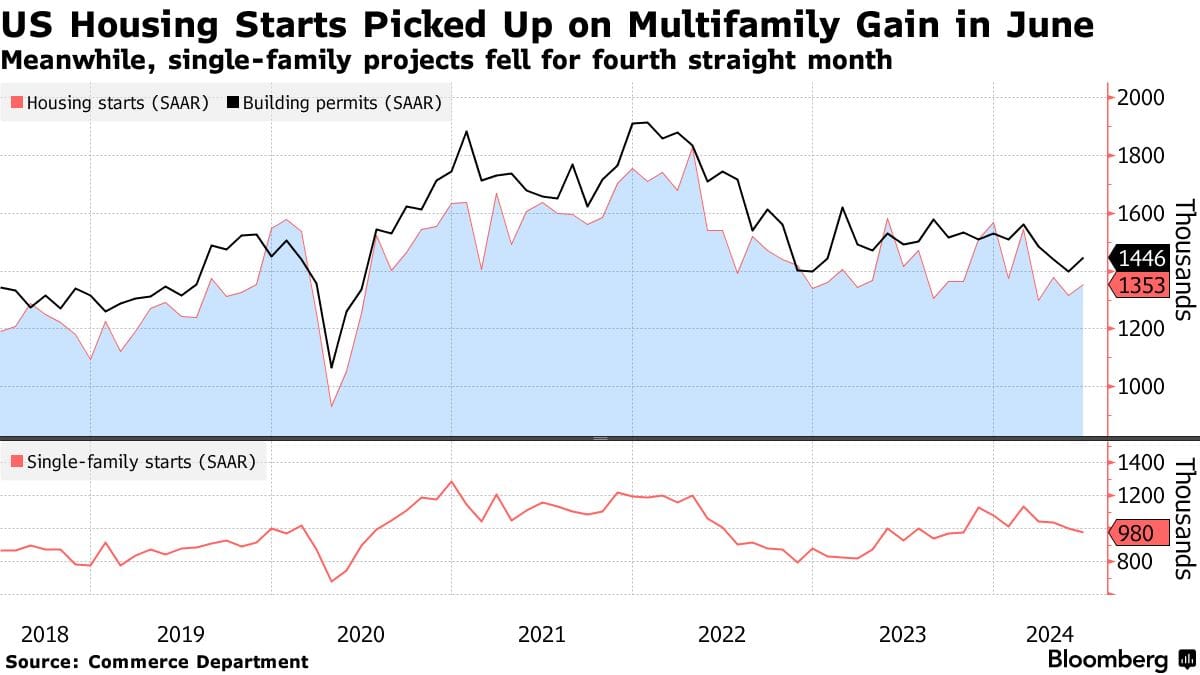

U.S. housing starts took a steep dive in July, dropping 6.8% to a seasonally adjusted annual rate of around 1.238 million units. Compared to last year, that's a 16% decrease, with the single-family home sector getting hit the hardest—a 14.1% drop in starts. But it's not all doom and gloom; multi-family starts actually jumped 14.5%. So, what's really going on here?

What’s Driving the Decline?

Economic Conditions:

High interest rates for construction and development loans are choking building activity. Builders are paying more to borrow, which means fewer projects are getting off the ground. And while mortgage rates have slightly eased, they’re still sitting near multi-year highs, making homes less affordable for the average buyer.

Supply-Side Challenges:

Builders aren’t just facing higher costs to borrow—they’re also dealing with labor shortages and skyrocketing prices for materials. Finding enough workers and suitable lots is like hunting for a needle in a haystack, and it’s slowing the entire construction market.

Regional Differences:

Regionally, the picture is mixed. Housing starts tanked in the South (-13.6%), West (-12%), and Midwest (-1.7%). However, the Northeast? It’s booming—starts jumped by a whopping 42.6%, offering a rare bright spot in an otherwise gloomy market.

Implications for the Housing Market

Inventory Levels:

The drop in single-family starts isn’t helping the U.S.’s chronic housing shortage. But, interestingly, housing completions actually rose by 9.8% from the previous month. This might help alleviate some of the tight inventory markets, but don’t get too excited—there’s still a long way to go before we meet the demand.

Builder Sentiment:

Confidence among homebuilders has been sliding for four straight months, and for good reason. The number of new single-family homes for sale is rising, with inventory now above a 9-month supply. Some areas might even be on the verge of oversupply—an ominous sign for prices and profits.

Investment Implications: Where’s the Opportunity?

Homebuilders:

It’s tough sledding for homebuilders right now. Fewer starts and permits suggest some near-term turbulence. However, keep an eye on the Federal Reserve—if they start cutting rates, that could throw a lifeline to both buyers and builders.

REITs:

Multifamily REITs might be the quiet winners here, given the rise in multi-family starts. This could expand their portfolios and provide steady income. On the other hand, single-family rental REITs may also find opportunities if the tight supply in single-family homes persists, keeping demand for rentals high.

Building Materials & Home Improvement:

Companies in these sectors might face weaker demand as construction activity slows down. However, the longer-term outlook could shift quickly if housing starts rebound due to pent-up demand or government intervention.

Mortgage Lenders:

A slowdown in housing starts typically signals less demand for mortgages, which could crimp lenders’ revenues. But again, a potential Fed rate cut could flip the script and reignite borrowing.

Is a Turnaround Coming?

While the current numbers suggest a bearish outlook, there are some silver linings. The U.S. has a structural housing deficit, meaning demand could surge once economic conditions stabilize. Plus, government policy interventions aimed at tackling housing affordability could stimulate building activity down the road. And let’s not forget about tech—advances in construction methods could reduce costs and speed up builds, potentially reinvigorating the market faster than expected.

Navigating the Housing Market’s Shifting Tides

The housing market is clearly facing some stiff headwinds right now, but that doesn’t mean there aren’t opportunities lurking beneath the surface. Investors should keep a close watch on key economic indicators, policy moves, and innovations in the industry—any of these could signal an inflection point in the cycle. It’s a tough market, but for those willing to brave the storm, the rewards could be significant.